Scope of Risk Management

Risk Management Courses Career Scope in Pakistan

Risk Management Career & Scope Employment Areas

Information Technology Field

Banks & Other Financial Organizations

Energy & Power Sector

Disaster Management Department

Insurance Companies

Multinational Companies

Educational Institutes

Stock Exchanges

Brokerage Houses

Forex Trading Companies

Government Finance & Planning Departments

In the modern world, it is an undeniable fact that companies cannot survive without the expertise of a risk management professional. The demand for such professionals ensures abundant job opportunities. However, to excel in this field, one must diligently prepare feasibility reports for diverse businesses and even offer financial advisory services. As professionals gain experience, they may eventually venture into entrepreneurship.

Staying updated with the latest research and market trends is crucial to remain relevant and meet the market’s demands. By continuously updating their skills and knowledge, risk management experts can build successful careers, secure stable employment, and potentially establish their own businesses in the latter part of their professional journey.

Risk Management Core Topics & Subjects

Introduction of Risk & Its Management

Theory of Probability

Latest data Analysis Techniques

Monte Carlo Simulation

Types of business risks & their solutions

Financial, operational & technical risks

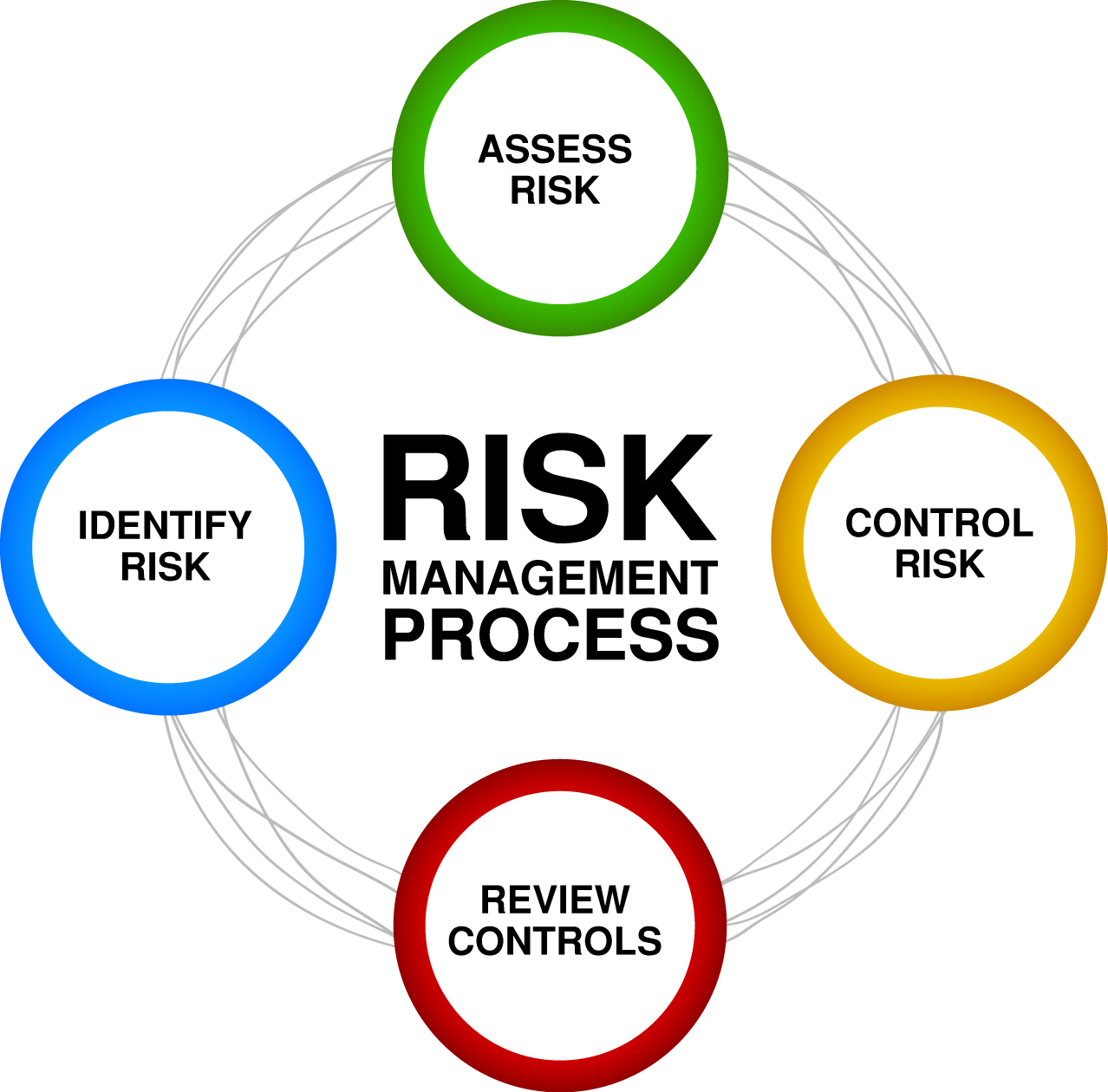

Risk identification-Categorization & methods of management

Risk analysis & assessment

Advantages

Risk elements

Risk factors logic

Evaluating risk impacts & solutions

How to select best option?

Risk Management in energy, banks, insurance, disaster management and IT sectors

A company’s profitability may be impacted by a variety of things, including

Accidents/Acts of God

Break-downs

Strikes

Shortage of raw material

Shortage of repair and maintenance staff

Out dated technology and machinery

Untrained human resources

Shortage of funds

Load shedding of gas and electricity

Loss of important data

Miscommunication

Lack of information & resources

Jobs in Risk Management Field

Many industries, including information technology, energy and electricity, banks, financial institutions, and insurance businesses, provide a wealth of employment prospects for risk managers. These specialists are in high demand in international corporations, catastrophe management divisions, stock markets, brokerage companies, government finance divisions, and government planning divisions.

They are vital assets for organisations functioning in dynamic and uncertain contexts since their experience is essential for recognize and minimizing possible hazards. Skilled individuals can find fulfilling professions and make major contributions to the profitability and stability of businesses and governmental institutions since a variety of sectors and departments require competence in risk management.