Career guidance on the Banking Profession in Pakistan is given, along with information on the range of bank jobs in Urdu and English. Jobs and Banking Profession Career in Pakistan Banking Sector Salary range with recommendations for the top field in Pakistan’s banking industry for qualified, highly educated, and experienced employees.

Let’s all investigate the specifics of a career in banking, or bank jobs in Pakistan. This career path is filled with a wide range of rewarding professional opportunities. One of the continuously growing industry sectors is the banking profession and industry. It has significantly aided the folks in building a solid career. You may find out the right information on the career paths that can be paved in the banking sector here:

[lwptoc]

The Major Job Types and Employers in Banking

- Types of Banking Jobs. Gary Waters / Getty Images.

- Bank Teller Jobs. YinYang / Getty Images.

- Loan Officer Jobs. Hero Images / Getty Images.

- Private Banking Jobs. AIMSTOCK / Getty Images.

- Investment Banking Jobs.

- Credentials for Banking Jobs.

- Leading Banks.

- Nonbank Lenders.

Eligibility Criteria For Banking Jobs

End-user consumers are dealt with directly by banking experts. Therefore, it is essential that candidates for bank jobs have strong oral and written communication skills. In order to convey financial concerns to their coworkers clearly, it is also crucial. To work in this profession, you need to have at least a bachelor’s or master’s degree; if you have an MBA or M.com, you can be posted as an MTO.

There are several specialities that the business schools provide, and you can pursue a degree that is solely associated with and related to the banking industry. There are several of master’s degrees that do provide concentrations in the banking industry. You can follow this banking career after earning a degree in finance, a graduate degree, or a master’s degree in economics.

Banking Profession Career in Pakistan Jobs Opportunities Scope Salary

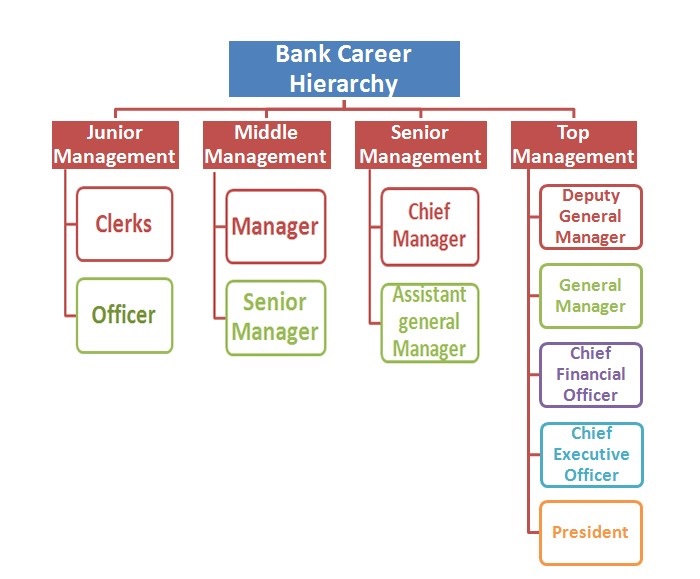

Banking Profession Career in Pakistan

- Chief Financial Officer.

- Finance Director.

- Banking & Commercial Loan Workout Manager.

- Bank Vice Presidents.

- CEO or Bank President.

- Hedge Fund Managers.

- Controller.

- Senior Direct Sales Representative.

Management Trainee Officer

This MTO position, which is a job title that is very career-oriented, is found in the banking industry. You will be posted and promoted to the operations manager position by virtue of being on this post and finishing your training. The management position will then become available to you after a while.

scope of the banking industry

You can work as an auditor, in which case you’ll essentially be an accountant with the responsibility of reviewing your bank’s financial records. It is the responsibility of auditors to apply their expertise to create new, more effective working procedures and methods. You should have extensive knowledge and support your firm to ensure that they continue to be fully compliant with tax laws.

The position of a broker is also well-liked and in demand in the financial industry. To locate clients and sell them these assets, commodities, stocks, bonds, and gold, these brokers must work for and represent investment businesses. They need to be up to speed on the procedures for carrying out all of these tasks.

Other Opportunities in The Banking Profession

- Communication skills.

- Problem solving.

- Customer service.

- Numeracy skills.

- Teamwork.

- Organisation and time management.

- Leadership and team management.

Your profession and vocation, if you studied law and are a working lawyer, would be the same. However, if you studied law and are now employed as, let’s say, a bank teller, your occupation/job would be that of a bank teller rather than a lawyer.

You may have the position of budget analyst, where your duties would entail creating a budget. These experts must coordinate and compile the whole budget planning process, as well as conduct the cost-benefit analysis. You have the option of choosing to become a financial analyst; these experts evaluate the performance of investment instruments like stocks and bonds.

Financial examiners—who are actually compliance officers—have a prevalent position in the banking industry. Financial institutions do a good job of hiring and selecting them, and one of their responsibilities is customer compliance risk scoping. Additionally, banks may offer financial services including safe deposit boxes, currency exchange, and asset management.

Bank jobs Salary in Pakistan

The estimated total pay for a Banker is PKR 120,000 per month in the Pakistan area, with an average salary of PKR 40,000 per month. These numbers represent the median, which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users. The estimated additional pay is PKR 80,000 per month. Additional pay could include cash bonus, commission, tips, and profit sharing. The “Most Likely Range” represents values that exist within the 25th and 75th percentile of all pay data available for this role.

FAQs About Banking Profession Career in Pakistan

What is Banking?

The traditional definition of banking refers to the job of managing the financial assets of the individuals who approach to a particular bank. A banker basically acts as a protector for their money. Banks lend money, generate interest that creates profits for the economy.

What is the job scope of banking?

Managing client bank accounts, including opening and closing accounts, and overseeing transactions. Processing deposits, payments, and withdrawals. Authorizing and evaluating overdrafts and loans. Handling other transactions, such as writing cashier checks or money orders, when necessary.

Which degree is best for bank job?

The minimum qualification needed for a job in Banking is a bachelor’s degree in Commerce or Management-related specialisation. Further for banking jobs, you will have to study quantitative aptitude, general awareness, reasoning, English and basic computer skills to ace bank exams!

How to start a career in Banking?

The minimum qualification needed for a job in Banking is a bachelor’s degree in Commerce or Management-related specialisation. Further for banking jobs, you will have to study quantitative aptitude, general awareness, reasoning, English and basic computer skills to ace bank exams!