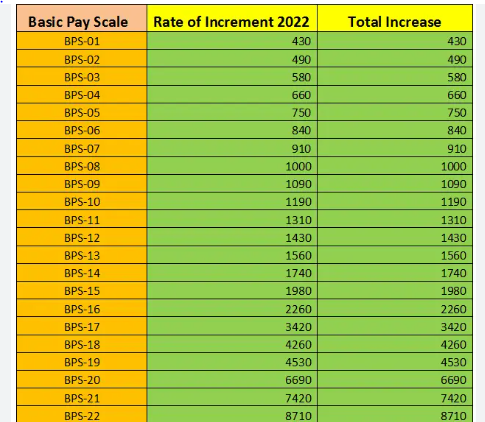

The detail of the increase in salary after the annual increment chart in December 2024 of all Government Employees of Pakistan.The Chart of Increase in Salary w.e.f 1st December 2024 due to Annual Increment 2024. According to the Notification issued by Govt, the relief allowance 2024 will not be increased as this has been frozen. These allowances will increase (if any). However, all the allowances being on the frozen level will not increase this year.

Annual Increment Chart in December 2024-24

At the end of the year, government employees in Pakistan eagerly anticipate the annual increment in December 2024. This salary increase is a significant event for BPS-01 to BPS-22 employees, providing a boost to their financial well-being. The government has outlined a comprehensive chart detailing the increase in salary for employees in different Basic Pay Scales (BPS). The annual increment, effective from 1st December 2024, is structured to benefit employees across various grades.

BPS-01 to BPS-22 Employees Chart of Annual Increment Dec 2024

|

Table of Increase in Salary wef 1st Dec 2024 |

||||

| Sr. No | Basic Pay Scale | Annual Increment 2024 | Increase in Any Allowance | Total Increase |

| 1 | BPS-01 | 430 | 0 | 430 |

| 2 | BPS-02 | 490 | 0 | 490 |

| 3 | BPS-03 | 580 | 0 | 580 |

| 4 | BPS-04 | 660 | 0 | 660 |

| 5 | BPS-05 | 750 | 0 | 750 |

| 6 | BPS-06 | 840 | 0 | 840 |

| 7 | BPS-07 | 910 | 0 | 910 |

| 8 | BPS-08 | 1000 | 0 | 1000 |

| 9 | BPS-09 | 1090 | 0 | 1090 |

| 10 | BPS-10 | 1190 | 0 | 1190 |

| 11 | BPS-11 | 1310 | 0 | 1310 |

| `12 | BPS-12 | 1430 | 0 | 1430 |

| 13 | BPS-13 | 1560 | 0 | 1560 |

| 14 | BPS-14 | 1740 | 0 | 1740 |

Frozen allowances

While the annual increment brings joy to government employees, it’s crucial to note that certain allowances remain frozen. These frozen allowances affect employees differently, and understanding their status is essential. The frozen allowances include:

| Sr. No | Name of Allowance | Date of Frozen or on the Pay as on |

| 1 | Disparity Reduction Allowance 2021 @ 25% | 1st March 2021 |

| 2 | Disparity Reduction Allowance 2022@ 15% | 1st March 2022 |

| 3 | Adhoc Relief Allowance 2022 @ 15% | 30 June 2022 |

| 4 | Adhoc Relief Allowance 2024 @ 30% and 35% | 30 June 2024 |

However, this allowance was frozen with effect from the same date.

Finance Division issued a Notification No. F. No.1(1)Imp/2023-226 dated 04-07-2023 in connection with Adhoc Relief Allowance 2024 (ARA-2023) @ 35% for BPS-01 to BPS-16 employees and 30% for BPS-17 to BPS-22 employees. If we look at the Notification we see that it is written that this allowance is 35% and 30% of Basic Pay as of 30-06-2023. If the pay at a later stage increases it will not increase. The Finance Division mentioned that on the pay as of 30-06-2023. It did not mention the running basic pay etc. If so then it would increase with the increase of pay.

Who will not Get the Annual Increment 2024?

Certain conditions apply to the receipt of the annual increment:

- Employees appointed on or after 1st June (afternoon) in 2024 are not eligible.

- Employees promoted, upgraded, granted time scale, or re-appointed after 1st June 2024 will not receive in 2024 unless they choose to fix the pay on 2nd December after receiving the annual increment in the previous pay scale.

- Some employees may face a penalty of stoppage of annual increments due to disciplinary cases.

In conclusion, the annual increment is a significant event for government employees, providing financial relief and recognition of their dedicated service. However, understanding the frozen allowances and eligibility criteria is equally important to ensure clarity and transparency in the salary increment process.